PRESERVING INVESTOR CAPITAL – THE FOORD WAY

Capital preservation is fundamental to compounding long-term inflation-beating returns. WILLIAM FRASER explains the importance of liquidity (see Did You Know?), patience, objective thinking and flexibility.

Capital preservation strategies differ from person to person. The most risk-averse investors may hoard their cash under the proverbial mattress. But bank or money market fund deposits that earn interest periodically with capital returned at maturity are most common.

Astute investors will however recognise the long-term limitations of these cash-based strategies:

• Short-term interest rate instruments offer a low real return before tax and often a negative return after tax and inflation

• They are not “risk free” as bank failures do happen, resulting in partial or total impairment of the investor’s deposit (banks with riskier business models lure depositors by offering higher-than-market interest rates)

• Longer duration (length of time) deposits that allow for higher interest rates also increase the probability of variances in the market value of the capital invested, often more than expected by risk-averse investors.

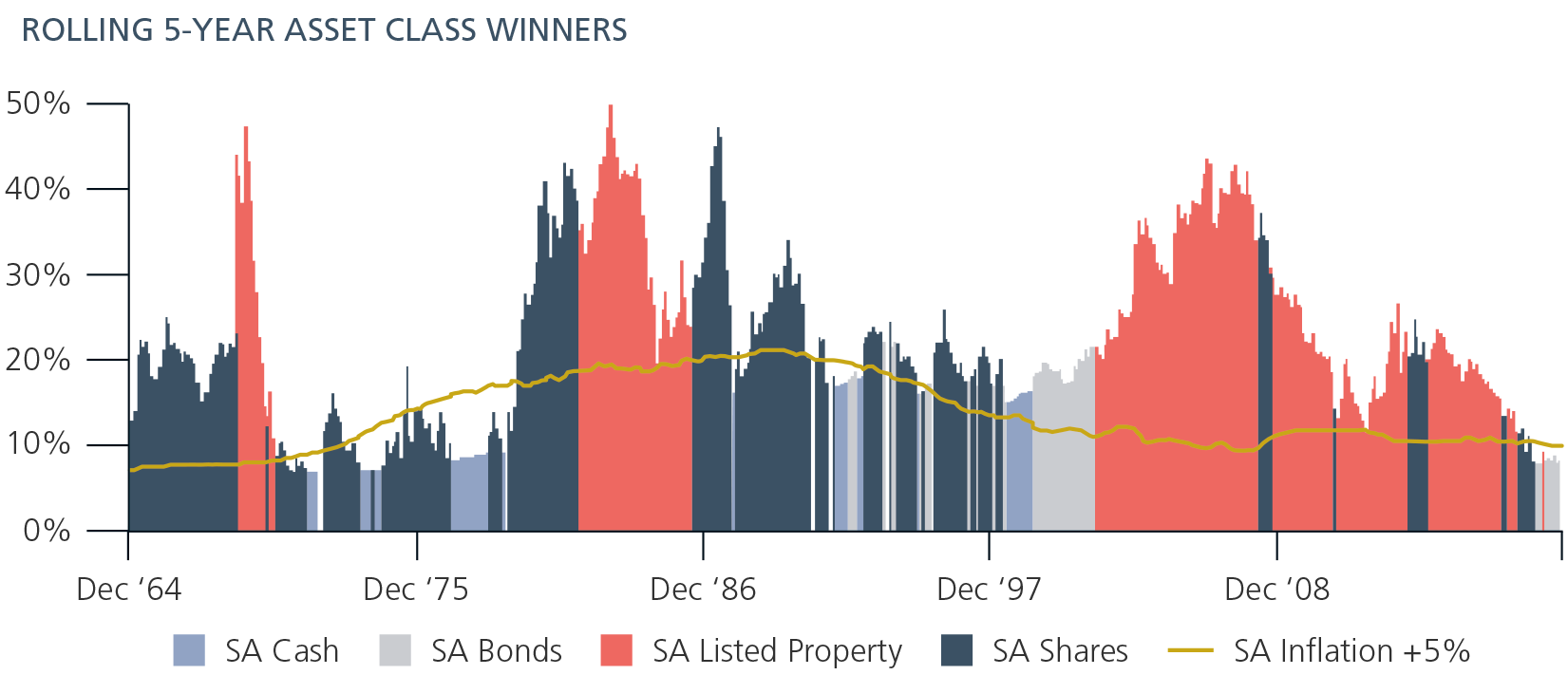

Cash and short-duration interest instruments thus rarely outperform growth assets such as shares or listed property over longer term periods. Cumulatively, when measuring all rolling five-year returns since 1960, bonds and cash have outperformed growth assets less than 20% of the time. But these periods are infrequent and short-lived (see graph).

Investors are now experiencing a rare period where cash and bonds are outperforming growth assets over the past 12 months and even five years (measured to the end of September 2019). It is therefore unsurprising that money market and income funds are now attracting the bulk of investor flows.

Longer term investment strategies such as equity and traditional balanced funds have lost out. This is typical investor behaviour, consistent with past cycles. However, it is damaging to long-term investment outcomes because the market mechanism soon ensures that growth assets again offer risk premiums sufficient to attract investors’ savings.

One of Foord’s key investment tenets is to preserve investors’ capital in real terms, that is after subtracting inflation. Further, we aim to achieve returns meaningfully above inflation to compound real capital growth. We believe inflation plus at least 5% per annum over a full investment cycle is achievable without undue risk. As we see from the graph, cash and bonds seldom achieve this outcome over five years. But these asset classes can achieve this goal over shorter time periods and therefore have their place in portfolios.

Achieving long-term inflation-beating returns requires patience. This is especially true when share and bond prices diverge drastically from market fundamentals. Broad investment choice across multiple and uncorrelated asset classes allows the portfolio managers to diversify investment risk while buying low and selling high.

We are not advocating short-term trading or trying to accurately predict a market correction (inflection point). Rather, market timing involves up or down-weighting asset classes based on the relative attractiveness of the market. This approach is based on a thorough analysis of the interest rate cycle which is a key component of all asset prices.

In our long experience, it is better to de-risk investment portfolios well before an expected inflection point as restructuring portfolios can become impossible in a bear market when trading volumes and liquidity dry up. In short, we prefer to leave the dancefloor while the music is still playing.

Being early in this way often results in short-term underperformance as other market participants extrapolate recent growth trends into the future. In each event, however, Foord’s investors have subsequently enjoyed much longer periods of outperformance.

Preserving capital during market downturns is only one aspect of long-term investment success. Moving early into the safety of cash, government bonds and defensive equities improves portfolio liquidity. This is critical when other investors rush for the exits when the inflection point hits.

Just as asset prices overshoot at market highs, they fall too far in bear markets. This gives us excellent buying opportunities. But investors can only benefit from bargain prices if they have enough liquidity, which is difficult to achieve in a falling market.

Bull markets tend to last much longer than bear markets. Positioning investor portfolios for the next bull market requires liquidity, patience, objective thinking and flexibility. Foord’s portfolios are now very well positioned on all four metrics.