STAYING THE COURSE

“When adversity strikes, that's when you have to be the most calm. Take a step back, stay strong, stay grounded and press on.” — LL Cool J. Portfolio manager NANCY HOSSACK revisits the thesis that share volatility is opportunity and not risk.

We all know that life doesn’t go smoothly and nowhere is that more true than in financial markets. The error rate for surgeons is somewhere around 0.007%. In contrast, most investment professionals would be happy if 45% of their stock picks underperformed the market. Adversity is something you must get used to if you’re an investor.

Even the best investments don’t offer a smooth ride. Take Tencent as an example, the principal asset of the JSE-listed giants Naspers and Prosus. The Tencent share price grew from HK$0.86 on listing in 2004 to a high of HK$681.50 in January this year. It has since retraced to HK$461.40 on adverse regulatory intervention, but has still yielded an average return of 44% per annum in Hong Kong dollars over 17 years.

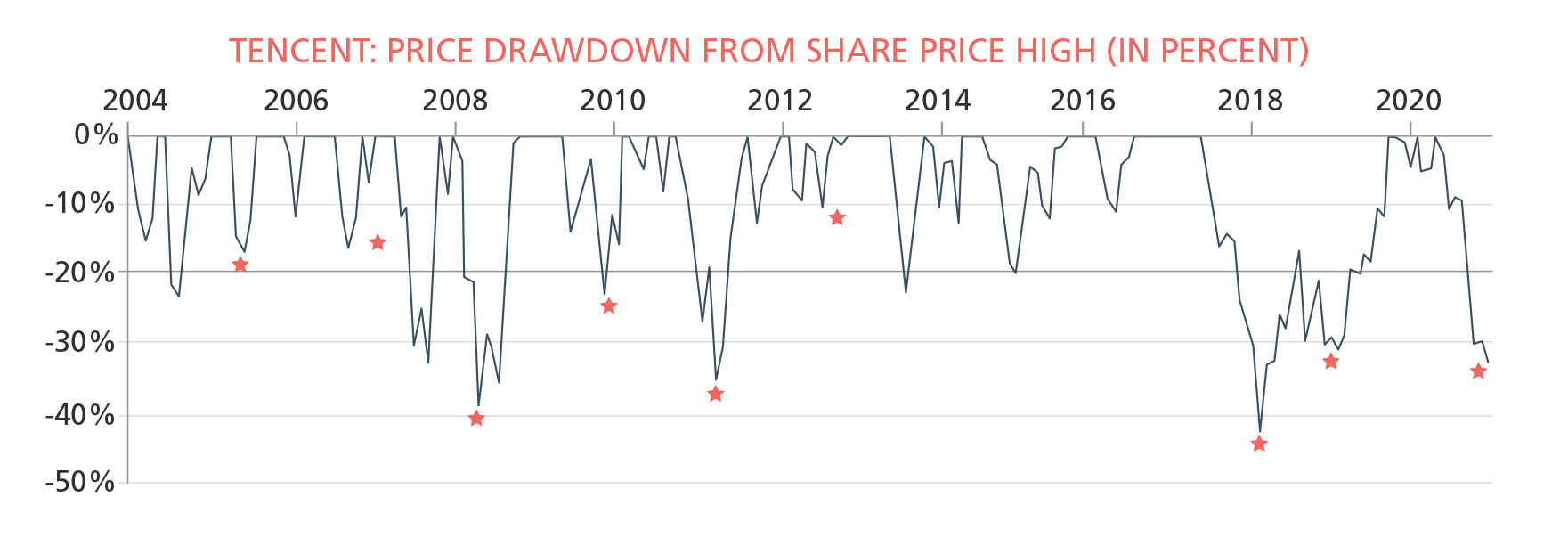

I must emphasise the ‘average’ part—to earn that amazing return, one would have had to white knuckle it (a lot). Given its volatility, the share has ‘lost’ more than 20% of its value eight times since 2004 (see graph which illustrates how the share has recouped all losses and made a new high whenever the line returns to X-axis). In fact, you only lost money if you sold in the dips.

So even one of the most extraordinary investments on global stock markets has continually made its shareholders look silly. How does one look through this type of volatility to avoid panic selling? The best way is to adjust your time frame. When evaluating the success of your investments (and investment managers), look at the longest time frame possible. This will give you a much better sense check and help you stay the course.

At Foord, we don’t focus on the next-quarter earnings of the companies in our portfolios. But we do care a lot about what they will be in three, five and ten years. That means that we don’t sell companies that might be facing a tough year if we are optimistic on their long-term earnings. We often buy more to take advantage of the market’s short-termism. Those long-term, high-conviction investments have been the cornerstone of our success.

It’s interesting to note that Tencent itself has pursued a similar strategy, by buying back its own shares when the market is too pessimistic. The stars on the graph show when company management bought back Tencent’s own shares. Their excellent track record and recent share repurchases reinforce our views on Tencent’s prospects from these levels.

This is one investment opportunity where we prefer to stay the course despite the current regulatory headwinds. Hopefully our investors will keep their eyes on the horizon too.