FOORD FLEXIBLE FUND TURNS 15

The Foord Flexible Fund of Funds is Foord’s best investment view unit trust for South African retail investors. Managing director PAUL CLUER profiles the fund’s investment objective and track record on its 15-year anniversary.

Foord launched the Foord Flexible Fund on 1 April 2008 to provide retail investors with a one-stop investment fund. We designed the fund with an unconstrained mandate to allow it to invest in all asset classes, both locally and abroad, in accordance with Foord’s prevailing best investment view. The investment objective is to sustainably deliver long-term inflation-beating returns without taking on undue risk. Its benchmark is South African inflation plus 5% per annum.

We structured the portfolio as a fund of funds to allow the fund manager to invest more than the regulatory maximum 20% limit into Foord’s flagship offshore fund, the Foord International Fund. At launch, the portfolio invested into a bespoke SA building block unit trust and the Foord International Fund. Today, it additionally invests into the Foord Bond Fund in SA and the Foord Global Equity Fund abroad.

The Foord Flexible Fund is not burdened by the arbitrary asset class restrictions or limitations that apply to typical ‘balanced’ funds such as the Foord Balanced Fund. Balanced funds are usually designed to comply with the prudential investment framework set for retirement funds (Regulation 28), which in the main restricts investment in two key growth asset classes: offshore investments and equities.

Asset allocation and stock selection are the key drivers of long-term performance. It stands to reason that a flexible investment policy that permits an unconstrained, dynamic asset allocation approach and high-conviction stock selection is well positioned to achieve superior long-term returns with manageable levels of risk.

It is a fallacy that unconstrained investment mandates imply greater investment risk. In our view, the reverse is true: fewer investment restrictions mean more tools to manage the risk of loss. It is important to understand that investment risk is not volatility of returns, but the chance of permanently losing capital.

The Foord Flexible Fund achieved a 15-year track record at the end of March 2023. This presents a good opportunity to evaluate the fund’s achievements with respect to its inflation-beating return objective and the premise that an unconstrained mandate is superior to a similar but artificially constrained investment strategy.

When evaluating a fund’s investment returns, it is useful to analyse data that covers at least one full business cycle. A business cycle is typically measured from one economic peak to the next peak, or one economic trough to the next trough. Within these cycles, periods of expansion (trough to peak) are typically much longer than periods of contraction (peak to trough).

The US has experienced 12 business cycles since the end of World War II, lasting almost six years on average, with some as long as 11 years. We are therefore confident that an analysis of the Foord Flexible Fund’s 15-year returns covers the full gamut of economic events typically associated with a business cycle, with all the attendant investment risks.

Indeed, in the past 15 years we’ve witnessed the last phase of the bull market that ended with the collapse of Lehman Brothers and the advent of the Global Financial Crisis, the correlated decline of almost all financial markets culminating in the June 2009 economic trough, subsequent loose monetary policy and massive government intervention in financial markets that birthed the ‘everything rally’, increased regulation, the European debt crisis, negative nominal interest rates, Brexit, SA’s ‘lost decade’ and, more recently, Sino-American trade wars, a global pandemic, the Russian invasion of Ukraine and the return of developed world inflation kicking off the fastest interest rate rises in 50 years. That’s quite the decade and a half.

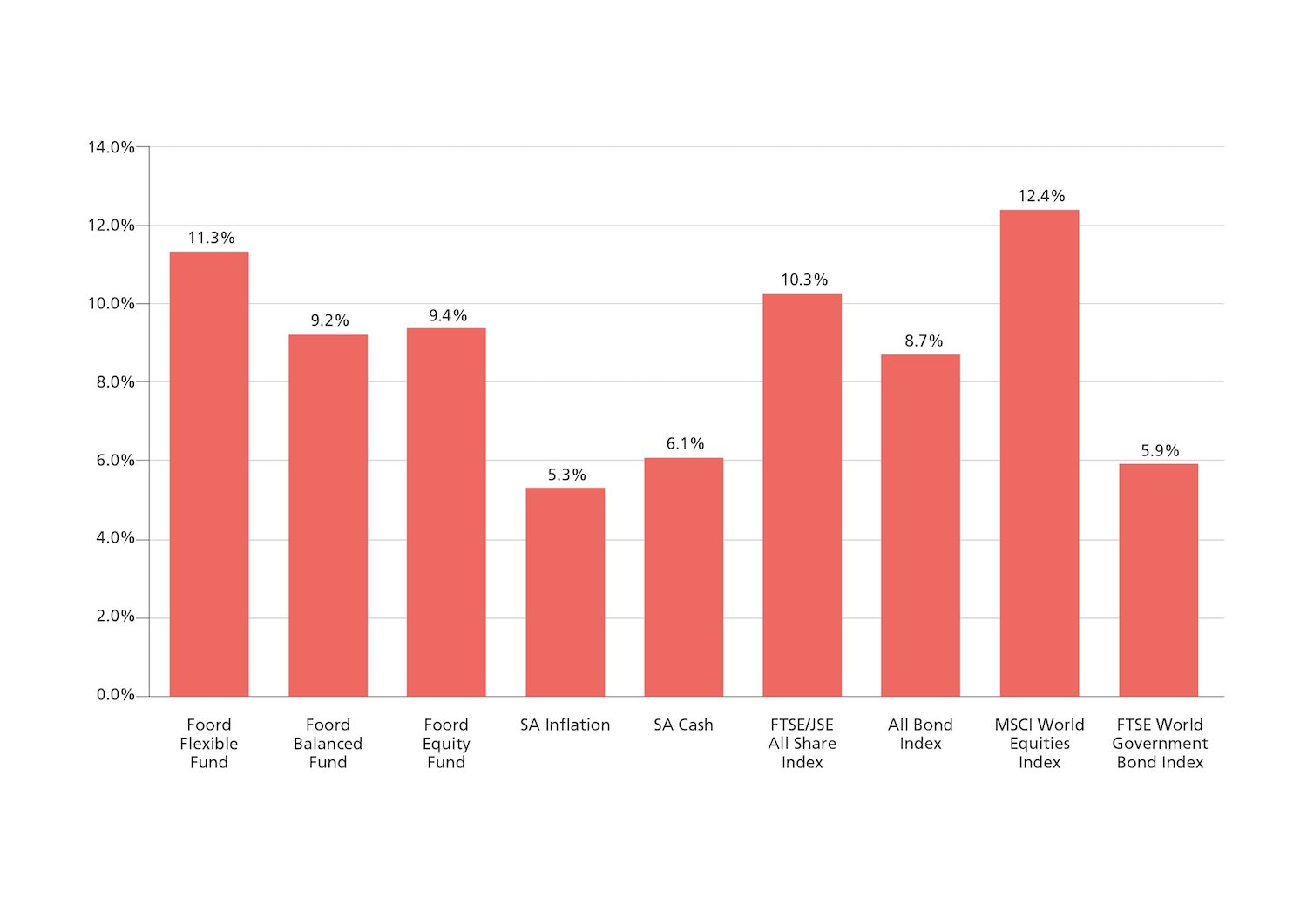

The accompanying graphic sets out the annualised returns in rands achieved by Foord on its Foord Flexible, Foord Balanced and Foord Equity Funds for the 15 tumultuous years ended 31 March 2023 relative to SA inflation and the investment opportunity set.

Despite the volatility in financial markets over this time, it has been a good period for investors in the Foord Flexible Fund, which achieved returns of 11.3% per annum when SA inflation has averaged 5.3%. It is also evident that astutely implemented and dynamically managed asset allocation decisions have helped the Foord Flexible Fund achieve a return that exceeds the returns of the key asset class indices, saving only global equities.

I mentioned that our original hypothesis was that an unconstrained, multi-asset class fund should outperform a similar but constrained investment strategy over time. Specifically, we believed that it would outperform the Regulation 28-constrained Foord Balanced Fund, which is ideal for investors investing via retirement fund vehicles, including retirement annuity funds.

The Foord Flexible and Foord Balanced Funds share a basic investment thesis. The implementation differs because of the constrained vs unconstrained nature of the respective portfolios. The cumulative return profile of these funds was initially similar, but started to diverge when the Foord Flexible Fund’s offshore and equity weights increased beyond what is possible in the Regulation 28-constrained Foord Balanced Fund.

Over 15 years, the Foord Flexible Fund outperformed the Foord Balanced Fund by 2.1% per annum (both net of fees and expenses). Our initial hypothesis has therefore been proved correct. The outperformance is substantial: an initial investment of R100,000 in the Foord Flexible Fund would have grown to R501,000 and be worth R126,000 more than an equivalent investment in the Foord Balanced Fund over this time. This difference will compound to many millions of rands when extrapolated to 30 or more years.

Successfully managing investment risk and compounding positive returns is the best way to achieve one’s long-term investment objectives. While we cannot promise that the Foord Flexible Fund will outperform the Foord Balanced Fund or all asset classes over the next 15 years, on paper it has the better credentials to produce the best long-term total returns.