Higher for longer – investing in an era of structural inflation

“Therein lies the most important lesson of investing…the biggest destroyer of capital is inflation.”

Dave Foord, Time in The Markets, 2011

INFLATION IS ALREADY HERE

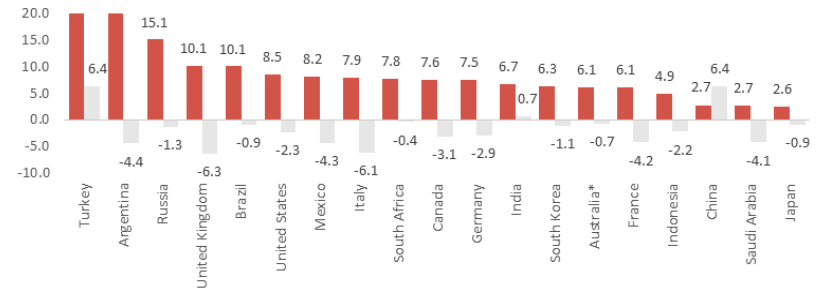

Having discussed the prospects for accelerating inflation more than two years ago, we continue to believe inflation to be more structural than transitory (or at a minimum for the transitory period of higher inflation to last longer than investors expect). A quick look at the 20 most economically influential countries shows that inflation has no doubt risen to multi-year highs.

Chart 1: Inflation in the G20 countries have risen to multi-year highs

Chart 1 source: Bloomberg, as at 31 July 2022. Grey columns show year-on-year inflation as at December 2020. *Australia as at 30 June 2022. Inflation in Turkey 79.6%. Inflation in Argentina 69.2%.

Our thesis is that inflation could persist in this environment given several contributing tailwinds.

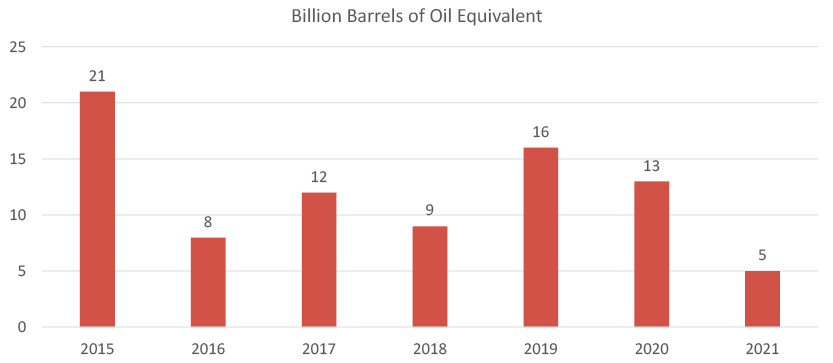

Firstly, we continue to see an underinvestment in traditional energy resources. This was amplified by the global pandemic which reduced exploration budgets to trim debt, pay dividends, and buffer losses from a US fracking boom. The unresolved conflict between Ukraine and Russia also continues to put pressure on the Oil and Gas supply chain. In addition, the increasing focus on Environmental, Social and Governance (ESG) factors, also played a part in seeing capital leave the sector. All these points to a prolonged multi-year supply crunch before renewable generation can account for a sufficient proportion of supply.

Chart 2: On track for the lowest discovery of oil in 75 years

Chart 2 source: Rystad Energy 2022 Review, June 2022.

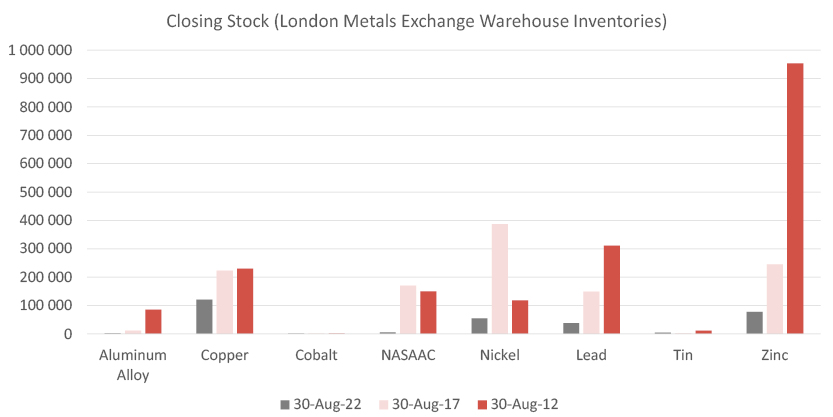

Secondly, global supplies of many industrial metals, including copper and several rare earths, required to further the energy transition, are currently not sufficient to meet demands from several sectors including infrastructure, information technology and green energy. ESG concerns are again restraining investments in mining and extraction capacity. Cost inflation is another reason why mining and rare earth companies could prolong their extraction cycle.

Chart 3: Metals inventories dwindling to historic lows

Chart 3 source: Bloomberg, as at 30 August 2022.

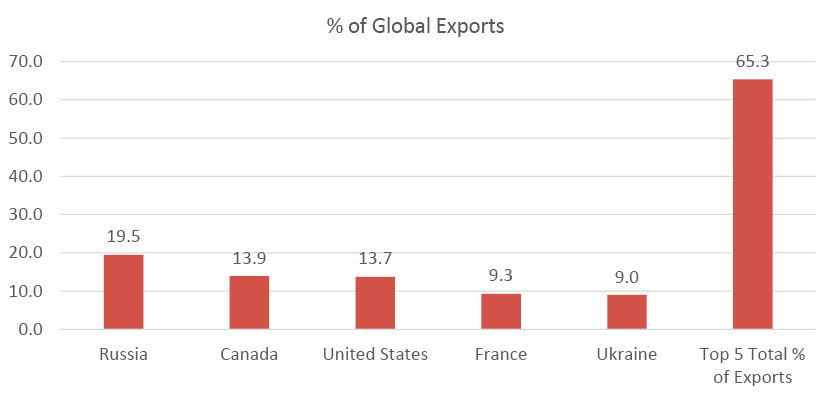

Thirdly, an often-overlooked area of inflation is agriculture. Food security has been emphasized as a result of the Russia / Ukraine conflict. However, this area of inflation is not looking to subside should the conflict come to an end.

According to the Observatory of Economic Complexity, as of 2020, both countries combined for more than 28% of global wheat exports. Hence, prices will remain elevated as countries globally are forced to rethink food dependencies and being able to procure at least a portion of their required food intake at home, regardless of cost. The current conflict has global ramifications as the rising price of wheat ripples through connected economies.

Chart 4: Over-reliance on five countries has global repercussions

Chart 4: Observatory of Economic Complexity (OEC). WHEAT AND MESLIN. Data as at 2022.

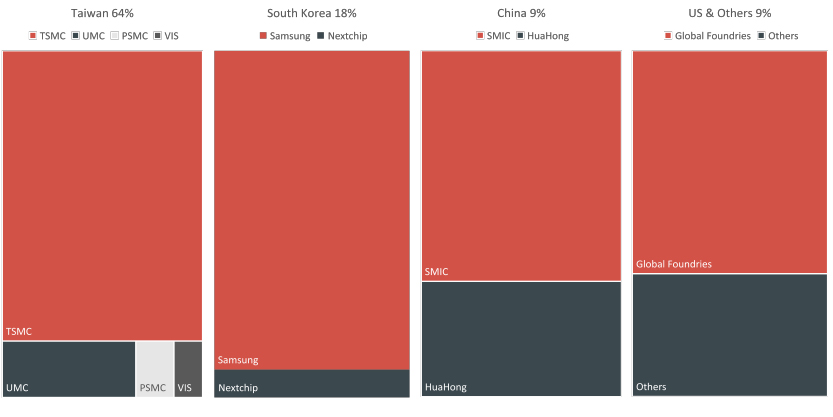

Fourthly, the current conflict in Ukraine, regardless of outcome, has countries onshoring strategic capabilities similar to what we are seeing in semiconductor chips. Even if only a portion of a countries’ semi-conductor demand is on-shored in the coming years, this will add to inflationary pressures.

In Europe, the European Union CHIPS Act, aims to capture a meaningful portion of production from South Korea and Taiwan. In the United States, the USD 280 billion CHIPS and Science Act has set aside USD 52 billion for onshoring production. In the race for strategic autonomy, political willpower will have to coincide with a large and continuous investment from both the public and private sectors seeking commercial gain.

Chart 5: Taiwan remains the world’s largest chipmaker (% of Global Production)

Chart 5 source: TrendForce, 31 March 2022. TSMC refers to Taiwan Semiconductor Manufacturing Company. UMC refer to United Microelectronics Corporation. PSMC refers to Powerchip Semiconductor Manufacturing Corp. VIS refers to Vanguard International Semiconductor Corporation. SMIC refers to Semiconductor Manufacturing International Corporation.

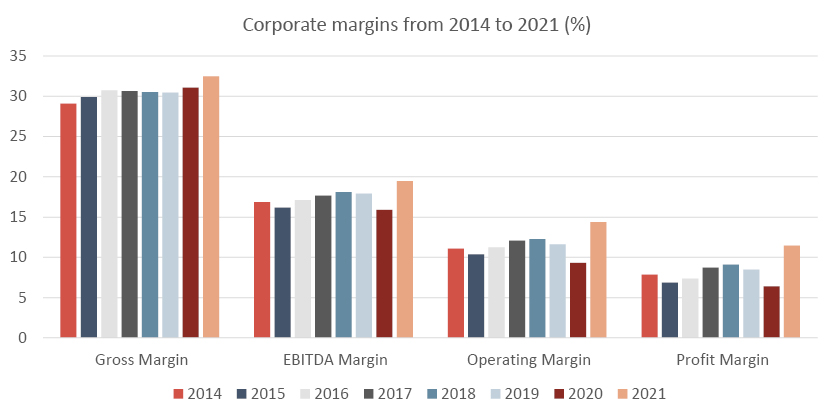

Lastly, we observe that corporate margins remain at record highs, a clear demonstration of the fact that profits have flowed disproportionately to the owners of capital rather than labor.

Chart 6a: Corporate margins are elevated

Chart 6a source: Bloomberg, 30 August 2022.

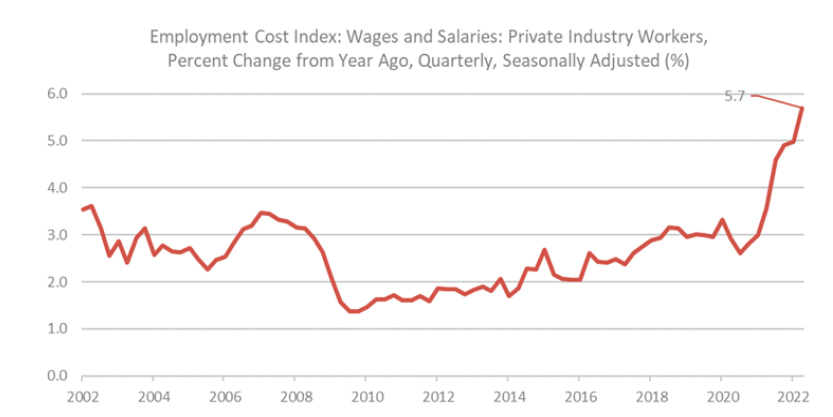

The reversal of this trend, already evident in many parts of the world, will continue with pressure on wages to remain or increase.

Chart 6b: Rising employment costs

Chart 6b Source: U.S. Bureau of Labor Statistics, Employment Cost Index: Total compensation for Private industry workers in All industries and occupations [CIU2010000000000I], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CIU2010000000000I, August 29, 2022.

OUR INFLATION PLAYBOOK

Behind the curve, global central banks have (and will continue to be hawkish) in their endeavor to stop inflation expectations from gaining/establishing a firm foothold in the consumer psyche. The probability of overtightening is far greater than zero.

In this environment, though not yet reflected in consensus analysts’ estimates, earnings growth rates are and will continue to moderate. We expect earnings to be increasingly challenged in the short term.

Investments wise, we think commodities and materials, as well as materials linked equities, offer a reasonable hedge against expected inflationary pressures.

In addition, for reasons other than inflation protection (of which it has historically been little correlated), we continue to believe gold will maintain its safe-haven appeal. The metal serves as a market-tested hedge during periods of volatility and has posted some of the best returns despite the headwind of rising real interest rates.

Within equities, we look for companies with strong pricing power which translates into persistent earnings and growing cash flow. These companies with sustainable competitive advantages tend to have strong moats and will outperform over a market cycle. During inflationary times, we also like companies with higher margins and lower debt.

Exposure to real estate will also buffer against inflation. Due to the pass-through nature of the sector, property prices and rental income tend to grow when inflation rises. Dividend income from real estate linked assets could also help match inflation.

For fixed income, investors should avoid fixed-rate instruments due to the inability to move with bank rates. Unsuspecting investors will find fixed rate payments consumed rather quickly when rates rise. In this space, floating rate debt is a potential alternative to ride out inflation due to its frequent re-pricing mechanism. However, exercise due care and diligence in assessing debt instruments, balancing risk and reward with your liabilities and investment objectives.

THE BOTTOM LINE

Inflation will continue to remain as a key risk for the foreseeable future, one of many risks that we constantly prepare for. Investors can take comfort that at Foord, constructing portfolios that are designed to not only survive but also thrive during all economic periods, including periods of high inflation, is what we’ve been focused on since our founding forty years ago.