A Long-Term View Of The Rand

We are frequently asked, “Where do you see the rand going?” The question is valid because investors wish to preserve and grow their investments in rand and dollar terms, an attainable long-term objective. WILLIAM FRASER explains why it’s critical to take a long-term view of the rand.

Questions about rand direction are normally framed for short-term currency moves, namely days, weeks or months. This is a notoriously difficult if not impossible exercise and is of little relevance to long-term investment outcomes.

The rand is a particularly liquid emerging market currency and displays significant short-term volatility. In the short term, fickle global investment sentiment drives currency flows and the direction and magnitude of those currency flows determines the rate of exchange against other currencies.

The unexpected rand strength experienced in the second quarter of 2017 is a perfect example of this phenomenon. Despite a deteriorating political climate, economic recession, foreign currency sovereign ratings downgrades and record-high unemployment in South Africa, the rand has advanced against hard currencies on the tailwinds of broader emerging market sentiment.

Unlike short-term currency speculation, long-term currency forecasts are an important component of Foord’s investment strategy. In the longer term (five years plus), fundamental economic realities like inflation and interest rate differentials are the primary drivers of the exchange rate between currencies. Yet, investors rarely ask our long-term currency views, which is a much more predictable and worthwhile exercise.

Broadly speaking, a country’s terms of trade, financial transfers and levels of fixed capital investment largely explain currency flows that affect exchange rates in the short to medium term. The terms of trade refers to the ratio of a country’s exports to its imports. Commodities dominate South Africa’s exports and therefore its terms of trade. Improving global commodity demand leads to higher commodity prices and improved terms of trade, usually ushering in periods of rand strength.

A stronger rand is a boon to importers and South African consumers and relieves inflationary pressures. But periods of prolonged currency strength can erode a country’s manufacturing competitiveness as companies rely on cheaply-imported components rather than investing in local capacity, while all exports become relatively more expensive.

South Africa’s financial markets are liquid and easily accessed by foreigners. Demand for SA’s financial assets, notably government bonds, surged after the Global Financial Crisis as foreign investors borrowed money in low-interest markets to invest in higher yielding SA assets. Alive to foreign demand for its bonds, the government borrowed heavily. Foreigners also bought copious quantities of JSE-listed shares.

These financial inflows had a positive effect on the exchange rate. The consequence however has been that SA companies and the SA government must now pay ever-higher amounts of interest and dividends to foreign owners of their securities. These financial outflows now well exceed the net proceeds SA enjoys on its trade account. The resultant current account deficit puts downward pressure on the exchange rate. Fixed capital investments by foreigners are longer term focused than trade and financial flows. Government policy uncertainty has deterred fixed investment into South Africa while simultaneously spurring South African businesses to diversify offshore. These factors work to weaken the exchange rate.

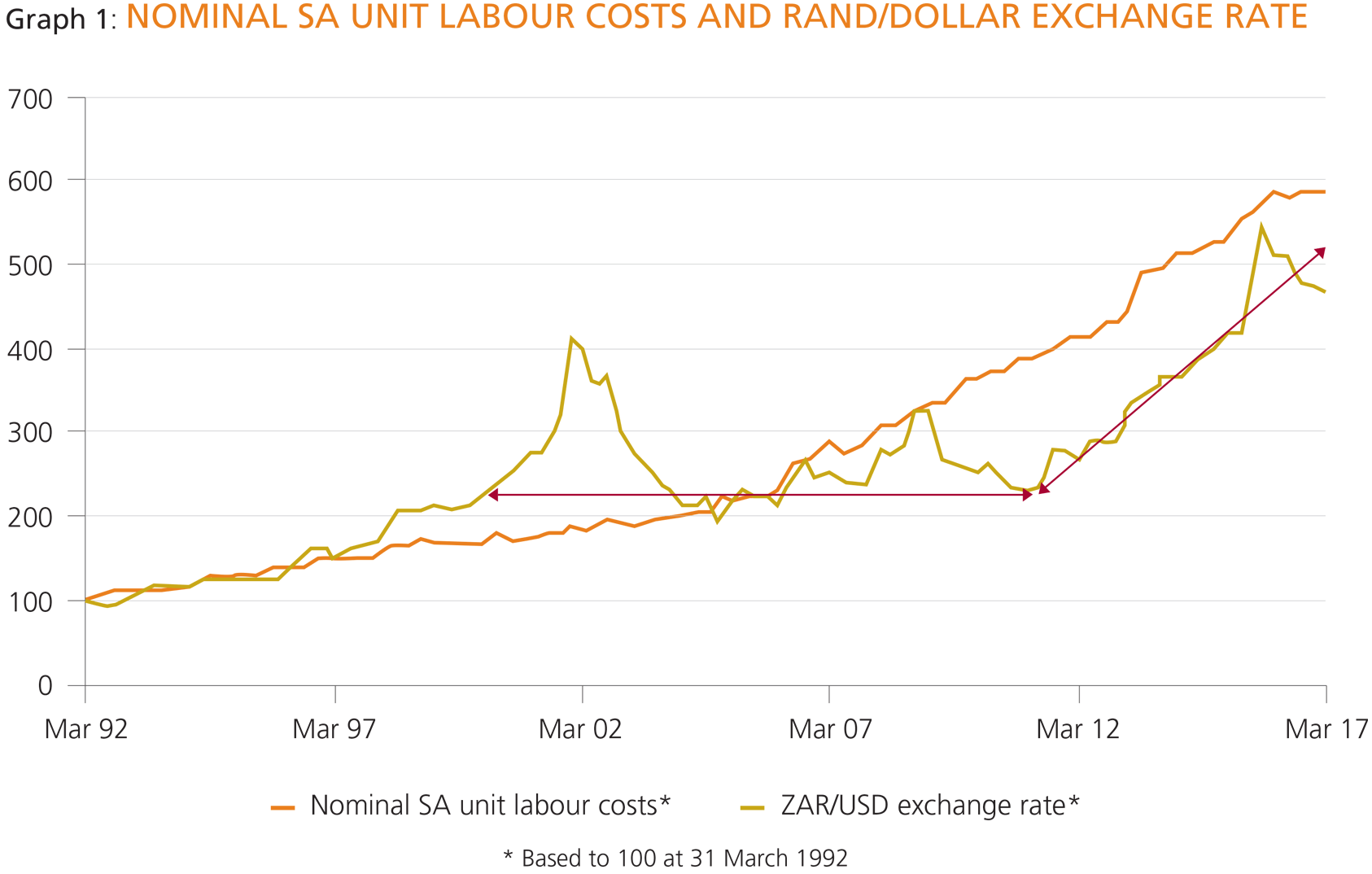

In the long term, the relative levels of inflation and interest rates (themselves interlinked) affect a country’s exchange rates. All things being equal, a country with structurally-higher inflation and interest rates should experience steady currency depreciation. South Africa’s unit labour costs are a proxy for price pressures in the economy and its global competitiveness. Graph 1 shows SA’s nominal unit labour cost growth for the past quarter-century relative to the rand/US dollar exchange rate. Over this time, foreign unit labour cost growth has been flat or negative, even in nominal terms, considering low levels of global inflation and productivity driven by technological advances and improvements.

The graph shows that, despite severe intra-period fluctuations, the rand was relatively unchanged for over a decade from the late 1990s until early 2011. During this period, the rand was affected by currency flows in one or other direction as described earlier in this article. At times, it was quite evidently undervalued and at other times relatively strong.

In the long term, the exchange rate must balance the relative inflationary pressures between SA and the US (in this instance). This implies further depreciation, especially off its relatively strong current levels. In the short to medium term, however, sentiment, trust, confidence and rather fickle global currency flows will lead to more random outcomes.